An Opportunity for Primary Care Professionals to Eliminate Student Loan Debt and Serve the Community

There is always a lot of activity in the medical industry and the last several years were no exception. The Affordable Care Act officially became law in 2010, reshaping significant portions of the healthcare industry and health insurance market. Similar to any large piece of legislation, some of the regulations meant new challenges for hospitals and physicians.

However, it was not all bad. The Affordable Care Act increased funding for the National Health Services Corps (NHSC) in an effort to support primary care health providers.

One of the ways the NHSC is supporting primary care medicine is with their Loan Repayment Program. Licensed and certified primary care professionals may qualify for education loan repayments of up to $50,000, if they meet certain criteria and choose to work at an NHSC approved facility.

The program has two clear objectives, address the shortage of primary care physicians and provide quality healthcare services to underserved communities. If communities have limited access to primary care services, for many it can mean going without regular dental check-ups, regular health check-ups and other preventative health services.

Loan Repayment Program Qualifications

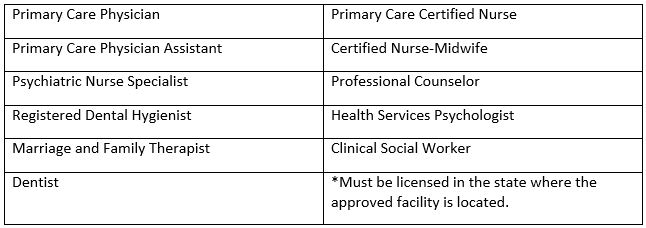

License Requirements:

Must be a licensed provider in one of the following categories

Employment Requirements:

The employment requirements of the program consist of three factors. First, an applicant must be employed or contracted with a facility that is approved by the NHSC. Second, the facility must be in a designated underserved area (HPSA). Third, a HPSA facility score will determine the level of repayment an applicant is eligible to receive. The repayment benefit can dramatically lower depending on the facility score; therefore, it is a good idea to research a provider’s score information before accepting a position.

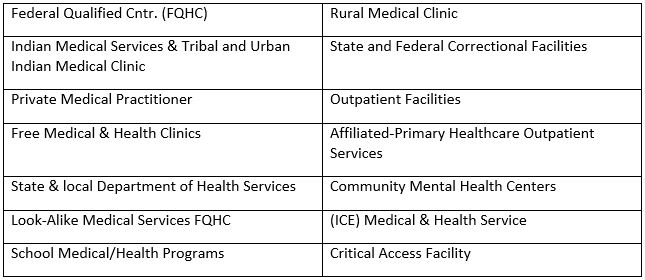

In most cases, eligible facilities are outpatient medical, dental or mental health providers. You can search for available positions at eligible facilities here. An applicant must make a two-year commitment of service to be eligible.

Types of qualifying facilities

- Must be NHSC approved

- Must be in underserved area as classified by HPSA

Educational Loan Requirements:

In order to qualify for the loan repayment program an applicant must have unpaid education/student loans. There are two classifications of student loans for this program, qualified loans and non-qualified loans. An applicant must submit loan documentation with the program application so the NHSC can verify all loan information.

Before beginning an application it is a good idea to gather all the paperwork for the loans including recent statements, original loan paperwork (if available) and lender information.

Qualified Education/Student Loans

Qualified loans are unpaid government education loans or education loans made by private student loan lenders, which were acquired specifically for paying reasonable undergraduate or graduate study expenses. Refinanced or consolidated loans may qualify if they have not been combined with ineligible loans. Final determination of loan qualification is determined by the NHSC.

Non-Qualified Loans

Loans that do not qualify for the programs are:

- Loans made to parents of the student

- Loans made by private foundations or friends

- Personal lines of credit

- Residency loans

- Credit card debt

- Loans that have been consolidated with non-qualified loans

Loan Repayment Benefits:

The benefit amounts can vary greatly based upon full time employment or part-time employment with the approved facility.

Full time applicants that serve a two-year commitment at an approved facility, with a facility score of 14 or better, receive a repayment of up to $50,000. If the facility score is 13 or lower, then the repayment is up to $30,000.

Part time applicants that serve a two-year commitment at an approved facility, with a facility score of 14 or better, receive a repayment of up to $25,000. If the facility score is 13 or lower, then the repayment is up to $15,000.

The Loan Repayment Program through the NHSC is a great way to alleviate the burden of large educational loans that were obtained while going through medical school. Once the initial two-year term is finished, employees can apply for additional years of service and additional repayment benefits. The maximum service is a total of 7 years and the repayment benefits drop slightly after the first two years. If you are interested in finding out more you can visit the NHSC website for application and program information.